An article by Zoe Williams in The Guardian, towards the end of July 2012, began:

The UK is the Saudi Arabia of wind

Dale Vince of Ecotricity said the same thing back in 2011:

Mr. Vince continued by saying that the UK is the ‘Saudi Arabia’ of wind energy, which makes Britain a potential to become an independent producer of energy.

And back in October 2009, I said the same thing at the Claverton Energy Conference. Anyway, enough of the source of this: let’s look at the numbers.

2011 was something of a boom year for Saudi Arabian energy production. The Arab Spring uprisings resulted in reduced output from other countries, meaning Saudi Arabia could significantly boost production without trashing the oil price. So let’s use its 2011 production as our benchmark. From the OPEC Annual Statistical Bulletin 2012, and converting from millions of barrels of oil per year into gigawatts, and from millions of cubic feet of gas per day into gigawatts, we see that Saudi Arabia’s annual rate of energy production was just under 800GW. By comparison, in 2011, UK average final electricity demand was 36GW and total final energy demand (including all gas for heating, and all transport fuels) was 183GW.

So, as the chart above shows, the UK’s annual average offshore wind resource is somewhere between 1.5 times larger, and 11 times larger, than 2011 Saudi Arabian energy production. And the great thing is that the wind won’t run out. It will vary, at all scales from seconds to decades, but it won’t run out as long as the sun keeps shining.

My own earlier estimate (shown above as Smith 2011) of over two terawatts as the UK offshore wind resource is documented on the Claverton Energy website. Using the same method as described there, and considering all UK waters, the resource is given above as Smith (2012).

Stuart Gatley, in his Masters of Engineering thesis at the University of Nottingham, models a range of potential future scenarios both for turbine density and turbine technology. His Scenario A-T1, assuming current technologies, is given as Gatley 1 above; whereas Gatley 2 is his Scenario C-T5, which assumes advances in turbine technology and the opening up of all UK sea depths as accessible to wind.

Giorgio Dalvit, in his Masters thesis “UK Offshore Wind Source”, produced a set of estimates, for different constraints. His estimate for the resource at less than 200 metres depth, and within 200km of shore, is given above as Dalvit 1; his all-area resource is Dalvit 2.

Why are there such different forecasts for the UK offshore wind resource? Because each analysis uses different assumptions. And they each use a different estimation method. Though, notably, they all use the same underlying data set: the Renewables Atlas. A future paper (being written now, in Summer 2012), will set out the different assumptions for each figure, and propose a new protocol for such assessments.

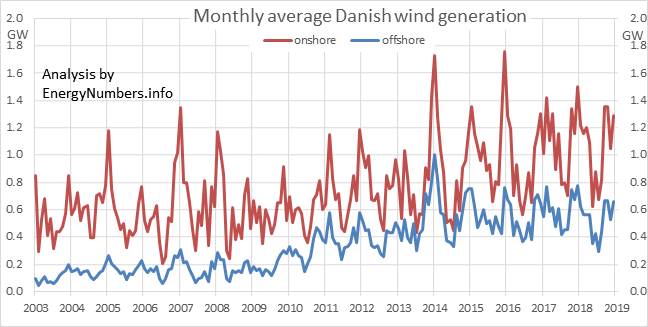

Here are the average

Here are the average ![Harald Pettersen/Statoil, NHD-INFO [CC-BY-2.0]](http://energynumbers.info/wp-content/uploads/sites/3/wikipedia-512px-Sheringham_Shoal_Wind_Farm_2012-300x198.jpg)